Here we go again ????

- Synthetic Resources Inc

- Jul 9, 2024

- 5 min read

Updated: Jul 12, 2024

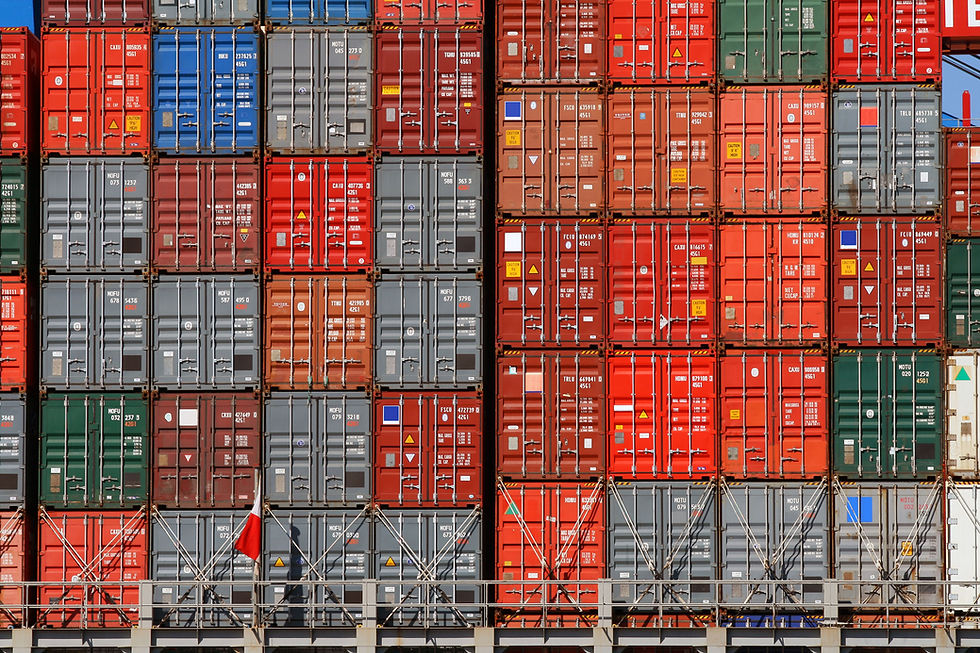

If we learned anything, history tend to repeat itself. During the pandemic we experience huge increase of 10 times normal freight cost during recovery with lack of space available. With the ongoing war and climate changes at Panama canals. Logistical issue continues to disrupt current supply chain for both ocean and air. The cost to run longer routes and repositioning and rerouting of containers have continued to climb. With looming of East coast Port strike and retailers looking to bring in all their merchandise to avoid strike and Election concerns. All these factors are creating current shortage on space and allocation of containers and send rates soaring 3 – 4 Multiple for west coast route. East coast cost is less affected due to demand is down and long transit time. This issue of newsletter we will continue to provide clarity on what is happening and where cost increases come in play.

US trade groups urge Biden’s help in restarting stalled ILA-USMX talks

The current six-year master contract between the union representing 45,000 dockworkers along the US East and Gulf coasts and the United States Maritime Alliance (USMX) is due to expire Sept. 30. While the ILA and USMX had hoped to get underway with master contract talks by summer after wrapping up negotiations at local ports, progress stalled when the ILA claimed that Maersk violated the master contract’s technology provisions by installing an auto-gate system at its APM Mobile container terminal. Read More

Ocean carriers unable to cover demand despite huge capacity injection

The strong demand for vessels on Asia’s export trade lanes is absorbing huge amounts of capacity being injected by carriers, frustrating efforts to manage unseasonally heavy volume and cope with longer voyages around southern Africa and congestion in key ports.

The scramble for imports on the trades out of Asia is the result of several factors, including Red Sea-related disruption, congestion at key load ports in Asia and the possibility of labor strife this fall along the US East and Gulf coasts. That is causing importers on Asia-Europe to jump sooner than they normally would, with knock-on effects for the West Coast supply chain.

Whether the early start to the traditional peak season will result in an early end has left analysts divided.

“We think the demand momentum could sustain during Q3 as shippers are keen to front load their cargoes ahead of Christmas to evade further disruptions, potential tariffs and further increases in freight rates,” Parash Jain, global head of transport and logistics research at HSBC, noted in a report this week. Read More

SR Inc., Your Source for GRS Certified Sustainable Textile Options

Our Commitment to Sustainability

At SR Inc.,, we believe that textile and sustainability can go hand in hand. As a leading textile provider, we are proud to offer a wide range of sustainable options that meet the highest industry standards. One of our key certifications is the Global Recycled Standard (GRS), which underscores our commitment to environmental responsibility.

What is GRS?

The Global Recycled Standard (GRS) is a globally recognized certification that verifies the use of recycled materials in textile products. It ensures that the entire supply chain—from raw material sourcing to production—meets strict sustainability criteria. By choosing GRS-certified textiles, you are making a positive impact on the environment.

Why Choose GRS-Certified Textiles?

Reduced Environmental Footprint: GRS-certified textiles are made from recycled materials, reducing the need for virgin resources. This minimizes waste and lowers the overall environmental footprint.

Traceability: With GRS certification, you can trace the origin of the recycled materials used in our textiles. Transparency is essential for conscious consumers.

Quality Assurance: GRS ensures that our products meet quality standards while adhering to sustainability principles. You don’t have to compromise on quality to make an eco-friendly choice.

Our Sustainable Textile Options

1. Recycled Polyester

Our recycled polyester fabrics are made from post-consumer plastic bottles. By transforming waste into wearable textiles, we contribute to a circular economy.

2. Solution Dyed Options

Our solution dyed product lines skip the dying process which save 1 ton of water for every dye lot. Offering less water polluted away from normal textile process.

3. Chemical incinerations: All chemical used in our coating process are incinerated safely so it passes Air quality control Management in Taiwan. Less Pollutant produced.

4. Biodegradable Options for both Nylon and Polyester based product are available in lighter weight fashion focus material.

If we can all chip in, it would make a cleaner future for the generations to come. Let’s work on a cleaner footprint to the next generation to follow.

1000D HT Nylon by SR Inc., vs. 1000D Cordura TM

Did you know our 1000D HT Nylon is also constructed with high tenacity Nylon? Comparison of SR 1000D Magnatuf Plus ) Nylon vs 1000D Cordura TM by Invista as below:

As long as your projects do not require Berry amendment, our 1000D Nylon can add value in performance and more price value than conventional Cordura TM.

Currency Market Influences

Currency: Complexity

As the world transacts in US dollars, lot of the key chemicals in textile such as basic CPL are still imported. A stronger dollar can also inflate raw material costs over time. With the dollar showing strength, the overall raw material purchase price is higher unfortunately, so the market has limited downside on price. With BRICS looking to challenge the Petro dollar it may present a very unpredictable market in the future.

Key Raw Material Price

Raw materials that impacts material cost : We carefully curate these information so you can see exactly what the domestic market see ongoing price and trades on material cost.

Below charts are spot rate data on key material components we collected from the current Textile Market spot rate. This typically project out 3-6 month direction of raw material price in China ( largest Synthetic Producer in the world ) . While it does not dictate all Asia price, it does influence the market and give us a peak on upcoming possibility. It provides some clarity on market trends in Asia based on material cost.

Nylon Chip China Internal & Nylon FDY

Nylon Yarn and Chip continue to travel in a lower range after March.

Polyester CHip & Polyester FDY

Trending of Polyester seemed to trend upward for both chip and DTY polyester yarn indicating higher demand and high prices to come.

In Summary, Nylon and Polyester raw material as projected last quarter did move higher after CNY. After the CNY the price is now correcting a bit as demand is still not strong . But due to energy cost on the raise. We are likely to see pressure to push the raw material price higher coming up month.

Crude Oil price

Oil prices continue to trend upwards this past quarter. This is adding pressure to increase raw material cost.

Let us know if the above research data helps to provide clarity on the trend in Asia Market and allow you to understand current market situation and condition. If there are more information you like to see , please let us know.

For many the concerns is on the raising cost of freight and availability of container to ship. We understand the freight increase will directly impact our client's competitiveness and profitability. During pandemic time we managed to create substantial savings 30-40% on freight cost from spot rates offered a the time. Save our clients substantial amount of cost while continuous delivery. We will continue to focus on delivering these value in 2024..

Comments