Is the Port Strike Postponement a Temporary Relief or Just Delaying the Inevitable?".

- Synthetic Resources Inc

- Oct 3, 2024

- 3 min read

Updated: Oct 4, 2024

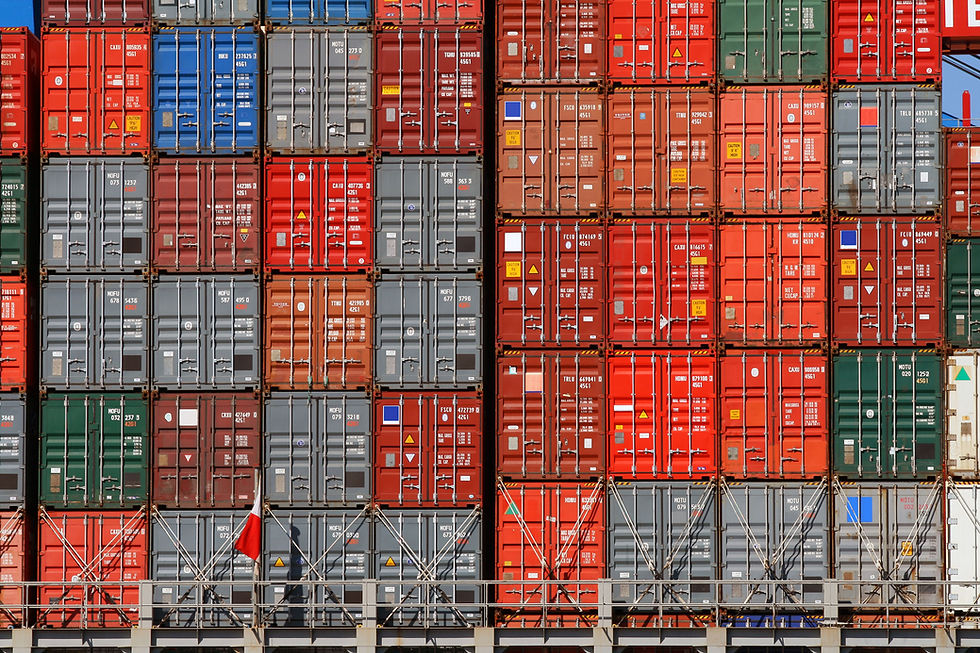

East coast port strike from Maine to Texas Suspended .

The port strike has been tentatively postponed to January 15, 2025, with an extension of the master contract. The International Longshoremen’s Association (ILA) has tentatively accepted a 62% wage increase plus royalties for each container processed. There are no further updates on automation or semi-automation at the ports at this time. Secretary of Labor Julie Su has been instrumental in working with both parties to reach this tentative agreement.

As it stands, the East Coast ports are expected to resume operations, with 55 vessels currently waiting outside. We will continue to monitor the situation and provide updates as they become available.

Sustainability

As we approach the end of 2024, sustainability and environmental care remain at the forefront of consumers’ minds. Past years, we proudly introduced recycled polyester, biodegradable polyester, and nylon, as well as recycled PVC and POE products to the market. We believe that being sustainable and eco-friendly extends beyond the materials we use to the processes we implement.

Our weaving operations now utilize solar energy to subsidize the electricity for our weaving machines. The water used in our air jet looms is collected, recycled, and reused, ensuring minimal waste. Our dyeing processes, located in an industrial zone, meet and are certified to the Oeko-Tex Standard for European environmental protection. All water used in dyeing is collected, recycled, and reused.

Additionally, our coating plant features a state-of-the-art exhaust system that incinerates 98% of the chemicals typically released into the air, significantly reducing air pollution. This plant is also Oeko-Tex certified.

Our goal is not only to offer recycled products but also to ensure that our manufacturing processes support environmental initiatives. We are committed to continuous improvement, so you can trust that our products are made responsibly.

Currency Update:

Currency:

As dollar trend weaker against measure Asia currency. It will put pressure on price.

Key Raw Material Price

We carefully curate this information to provide insights into the ongoing prices and trades in the domestic Chinese market.

Below are charts showing spot rate data on key material components collected from the current Textile Market spot rates. While these rates do not dictate prices across all of Asia, they do influence the market and offer a glimpse into potential future trends. This data provides some clarity on market trends in Asia based on material costs.

Nylon Chip

FDY Yarn. – Market is very volatile as last part of year usually drive the market up due to upcoming CNY . Demand are typically high before the holidays . The Yarn price is hotting highest price this year.

Nylon Chip – raw material wise price was down due to high capacity weak demand but transactional volume is low as factory is not willing to sell low.

Polyester Chip

Price is consolidating in the past few month , but showing price of raw material price actually declined in past few month due to lack of demand

DTY Polyester

Textured Polyester Yarn running high for past quarter but demand is creating an unstable market. Direction is mixed judging by the data.

In Summary, Nylon and Polyester raw material are experiencing weak demand with price hitting new lows.

Oil prices have been trending lower due to a combination of factors. One major reason is the slowdown in China’s economy, which has reduced demand for oil. Additionally, concerns about a potential recession in the U.S. and weak economic signals from Europe have further dampened the global demand outlook. On the supply side, the U.S. has been producing oil at record levels, contributing to an oversupply in the market1. Despite geopolitical tensions, actual oil production has remained stable, adding to the downward pressure on prices. Many wonder this policy shift is due to election in 2024 to push down oil price.

Conclusion

With China facing a severe economic crisis, Russia engaged in a devastating war with Ukraine, and Israel involved in conflict in the Middle East, the world is experiencing significant turmoil. Meanwhile, the U.S. is awaiting its November elections, which will shape its future direction. In these challenging times, global interdependence is more apparent than ever. We hope for the resolution of all conflicts so that we can thrive together as one world.

If there are any information your like to see more off on our newsletter/blog please email us @ clientservice@srinc.us

Comments