"Synthetic Resources: A Look Inside Our Quarterly Newsletter"

- Synthetic Resources Inc

- May 2, 2024

- 4 min read

Updated: May 3, 2024

Celebrating 20 years in this ever changing industries. More excitement to come.

If you would like to take a tour of our OEKO and GRS certified factory : Click : Tour

International News :

No end to US trade war with China, Biden administration pledges in policy document

South China Morning Post

Sat, Mar 2, 2024 4 min read

US President Joe Biden's administration issued a policy document on Friday that pledged to double down with a strategy of realignment on trade with China, a sign that tension between the world's two largest economies shows no signs of abating.

The 2024 Trade Policy Agenda and 2023 Annual Report to Congress released by the office of US Trade Representative Katherine Tai, sought continued action against "harms wrought" by what it called Beijing's "trade and economic abuses".

"We are also considering all existing tools - and will seek new ones as needed," the report said, contending that actions so far had allowed the US to "engage and compete" with Beijing "from a position of strength".

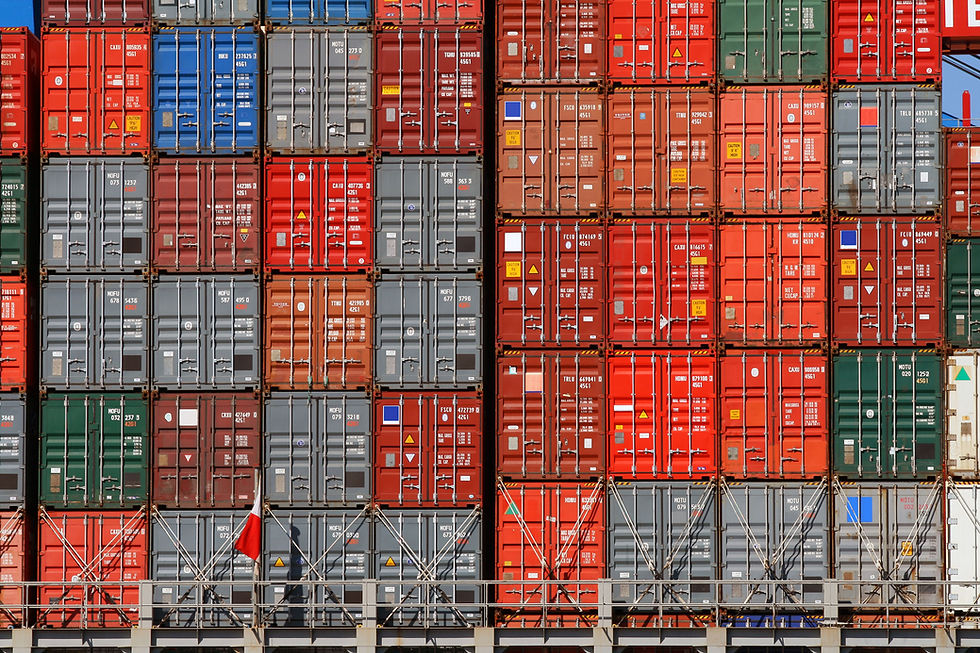

"Possible Union Labor Strike for East Coast Port "

Opinions mixed on potential for disruption as ILA contract deadline inches closer Some observers believe the ILA’s wage demands might be too high for ocean carriers who dominate the United States Maritime Alliance. Photo credit: Daniel Wright98 / Shutterstock.com.

MaritimeContainer linesLongshore laborNorth American ports

Peter Tirschwell | Apr 25, 2024, 8:00 AM EDT

As dockworkers along the US East and Gulf coasts negotiate local port agreements ahead of a mid-May deadline set by their union president, management sources are divided on the risk of disruption as the Sept. 30 expiration of the current contract approaches. Opinions range from believing a deal will get done with no disruption to a view that a bona fide threat of a strike exists.

International Longshoremen’s Association (ILA) President Harold Daggett last November announced that union rank and file would not work beyond the contract expiration if a deal were not in place, threatening what would be the first strike along the East and Gulf coasts since 1977. Read More

Textile Recycling Market To Reach USD 11.9 Billion By 2032, Says DataHorizzon Research

The textile recycling market size valued at USD 6.8 Billion in 2022 and is anticipated to reach USD 11.9 Billion by 2032 at a CAGR of 5.9%.

Fort Collins, Colorado, May 01, 2024 (GLOBE NEWSWIRE) --

Demand for fast fashion propels the textile recycling industry.

The rising emphasis on sustainability is a pivotal driver propelling market expansion. The detrimental effects of fast fashion trends and disposable clothing on the environment are profound. As highlighted by the UN Environmental Program, the prevalence of fast fashion has led to garments being worn fewer than three times before disposal, resulting in a staggering accumulation of textile waste that urgently necessitates recycling for environmental preservation.

Furthermore, the adverse environmental impacts stemming from apparel production, including land and water pollution and CO2 emissions, are fueling the growing demand for sustainable alternatives. Earth.org reports that the United States generates approximately 37kg of textile waste per capita annually, underscoring the magnitude of the issue.

New Era of more sustainable option for laminating for 2024.

We are excited to introduce to you a new addition coming on Line 2024 in our facility in Taiwan - PUR glue laminating machine . We heat the PUR glue to a molten state and upon application, bond is created between the materials until it cools. A chemical reaction builds up the strength of this bond over the next 72 hours as water molecules in the atmosphere transform the adhesives into a thermosetting polymer. Offering better bonding and no off gasing from traditional lamination. This is the new non-pollutant sustainable process. If you have 2 layer , 3 layer project that require lamination please reach out to us @ clientservice@srinc.us. This can be used for outdoor gears for water proof breathable jackets and gears to medical products etc. Let us know how we can add value to your product line.

Cost Trending :

Currency: The 2 main currencies that can affect raw materials and the cost of goods are trending higher at this moment, which is creating pressure for cost increase in raw materials. As the world transact in US dollars, lot of the key chemicals in textile such as basic carprolactum are still imported. So a stronger dollar can also inflate raw material costs over time. It will balance for a short time as exchange rate is more favorable for US dollar purchase for the time being.

Key Raw Material Price

Raw materials that impqcts material cost : We carefully curate these information so you can see eactly what the domestic market see on on goin price and trades on material cost.

Below charts are spot rate data on key material components we collected from the current Textile Market spot rate. This typcially project out 3-6 month direction of raw material price in China ( largest Synthetic Producer in the world ) . While it does not dictate all Asia price, it does influence the market and give us a peak on upcoming possibility. It provide some clarity on market trends in Asia based on material cost.

Nylon Chip : Pricing recover a bit but loosing steam.

Nylon FDY

Price recovered in the past 3 month but maintaining.

Polyester Chip

Price recover to its highest in past 6 month before it start to self correct adjusting to demand.

DTY Polyester

Again price peaked in beginning of April and now self correct a bit.

In Summary, Nylon and Polyester raw material as projected last quarter did move higher after CNY. After the CNY the price is now correcting a bit as demand is still not strong . But due to energy cost on the raise. We are likely to see pressure to push the raw material price higher coming up month.

Crude Oil price

Oil prices continue to trend upwards this past quarter. This is adding pressure to increase raw material cost.

Summary: At Synthetic Resources , our culture is to add more value than anyone else. Any feedback you can provide to us on how we can improve the newsletter , please let us know.

Comments